Welcome to the Ohio General Assembly's Great Legislative Education Robbery of 2025

Rural and Urban Districts all get hammered by crazy House Property Tax Plan

This Ohio House plan to rob $4.3 billion from Ohio’s public school kids who live in fiscally responsible school districts just keeps getting worse. Looking at which kids in which districts get hurt the most, I can honestly say it doesn’t really matter.

They’re all screwed.

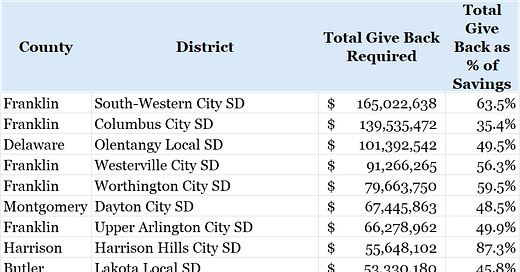

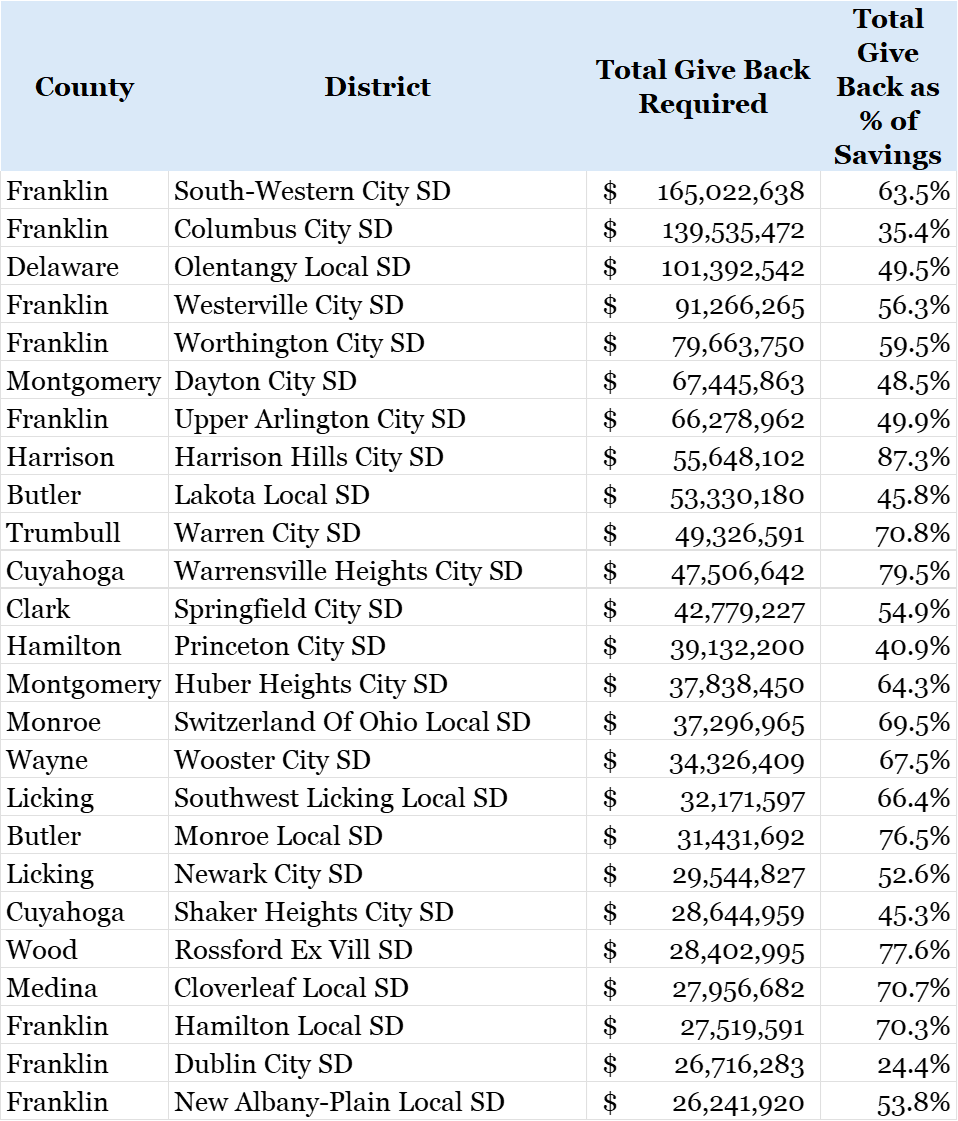

For example, here are the 25 school districts that have to give back the most money under the House Plan (such as it is):

You’ll see what you’d expect — districts that have the most kids have the most money to lose. But you’ll also see that staggering percentages of their savings just go Poof! under this House Plan.

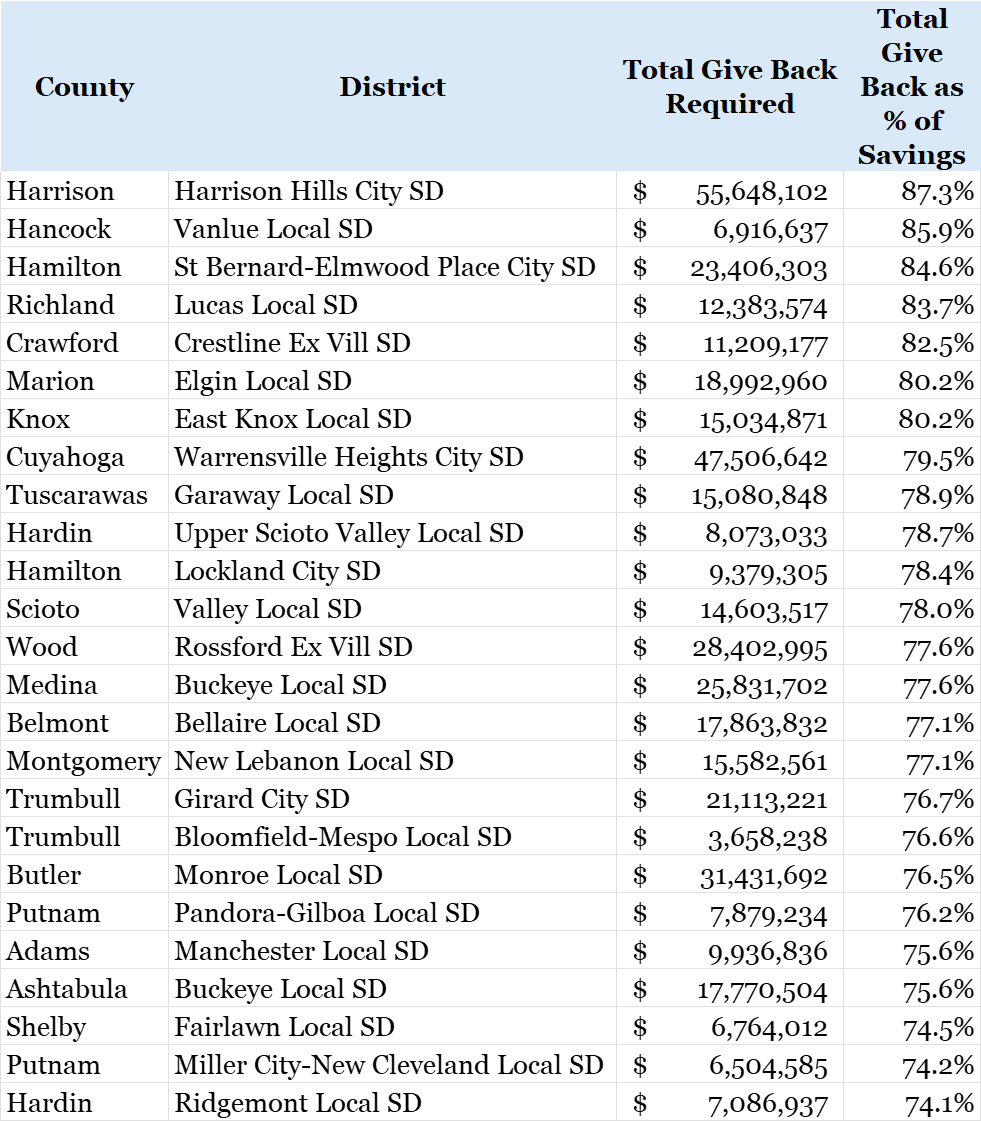

Here are the top 25 districts in terms of losing the largest percentages of their savings by General Assembly fiat:

You’ll see that these are districts in the heart of Appalachia1 — Trump Country, if you will. These districts raise paltry sums on property tax levies.

I’ve posted the list of districts and what the state’s about to rob from them here, in case you’re interested.

For example, Vanlue Local School District raises $63,000 on one mill of property tax. How paltry is that?

The state average is $639,629, or about 10 times what Vanlue raises. Do you think that might be why Vanlue has diligently saved nearly $8 million? Can you understand why they might be freaking out about the state forcing them to return all but $1.1 million of that?

In order to replace that $6.7 million, Vanlue would have to put a 106-mill levy on the ballot, which would cost the owner of a $100,000 home about $5,600 a year!

And that’s just one of these districts.

Lots of the districts on the second list raise similarly small sums of property tax revenue per levy and these savings clearly are hedges against economic downturns that these communities can’t weather otherwise.

As for the larger districts that raise larger property tax revenues, I can’t imagine anyone saying, “You know what? Let’s have the Ohio General Assembly steal $139 million from kids in Ohio’s largest school district because that will definitely benefit kids in Columbus City Schools!”

And one more thing: while the money the state is stealing from kids in public school districts will be going to lower property tax rates, the actual money the districts have saved isn’t only property tax revenue. It’s made up of property taxes, income taxes (nearly $700 million a year districts collect comes from their own income tax levies) and state revenues, which in turn are made up of sales, income and other taxes.

I don’t honestly know if Ohio legislators understand this, but when revenues come into school districts, all the money is put into expenditure line items. It’s not like the districts put all the property tax revenue into on stream and that only pays for teachers, or all the income tax revenue goes to pay for buses.

This may sound elementary, but I think our legislative leaders are about on that level of sophistication here: All school district revenue goes to pay for EVERYTHING!

In short, this plan dictates that revenue collected under all methods pay back taxpayers who’ve only paid through one method.

If you’re taking all our taxes and only reimbursing those who pay property taxes, I’m thinking there might be an equal protection issues there. Just sayin’. Not that they give a shit about Equal Protection anymore. But there you go.

Yet that’s what these geniuses are doing.

But at least their genius is only matched by their craven political weakness.

Like I mentioned yesterday, I am not a fan of public entities hoarding money in order to claim “fiscal responsibility” as an excuse to not spend it to serve a public good. Given what happened to Gov. Ted Strickland when he spent Ohio’s Rainy Day Fund in 2009 so teachers would still get paid during the Great Recession, I don’t think any Rainy Day money (there’s a record $3.9 billion in the state’s fund now, in case you’re wondering) will ever get spent in this state, even if Noah were building the Ark.

By the way, isn’t it interesting that the state is raiding school districts’ Rainy Day Funds, but refusing to touch their own, which is about the same amount?

Anyway, this isn’t some “districts aren’t spending enough of their money on kids, so we’re going to force them to” policy change. Because if you were doing that, you’d give districts an off ramp. Give them 2-5 years to spend down that amount to your arbitrary 30% cap or something.

This is “you’re losing 75-90% of your savings July 1” kind of crazy.

That’s because this plan is being done for one purpose: Getting property taxpayers off their backs. It’s not some grand policy play. It’s pure politics.

And once again, as is so often the case in Ohio, public school kids are these geniuses’ political football.

Disgusting.

Two districts — College Corner and Put-in-Bay are technically included in this list, but they are considered outlier school districts. So I didn’t include them here, though you’ll see them in the list of all districts I posted on Scribd.