"Trump Recession" or "Trump MAGA 2.0"?

“川普衰退”,還是“川普MAGA 2.0”?

By Hong Qian

共生經濟學人綜合古典經濟學,將奧派經濟學的四大發現——1、價值的主觀性(消費者對差別勞動的選擇偏好);2、金融的高尚性(自利在流通中帶來更多利他);3、企業家的偉大性(破壞性創造帶來生活方式的再選擇);4、市場的可持續有效性(分散的認識與個人決策在試錯、糾錯動態平衡中臻於完美)——並將其置於共生語境中,進一步發現貫通其中的“共生經濟效應(自組織連接動態平衡)”,由此得出人類政治經濟組織行為,悉皆遵循“開放降本賦能”成本/收益之經濟健康黃金率函數(因變量)關係,將導出全球政治經濟組織行為“從資本論的分配經濟學,到社會論的共生經濟學”的八大轉變。

——摘自《共生經濟學SYMBIONOMICS》

自川普正式成為第47任美國總統以來,市場經歷了一場恐慌震盪。美股在他上任後的前幾周出現大幅下跌,部分媒體和經濟學家再唱“川普衰退”論調,諸如“美國通脹即將再起”“美聯儲將再次加息”“全球投資市場將面臨嚴重危險”“市場會出現幻覺和暴跌”等等,不一而足。

那麼,到底是“川普衰退”,還是“川普MAGA 2.0”?共生經濟學人認為,大概率是“川普MAGA 2.0”(參看《 MAGA 2.0:從保護主義到全球共生戰略》http://symbiosism.com.cn/9429.html)!

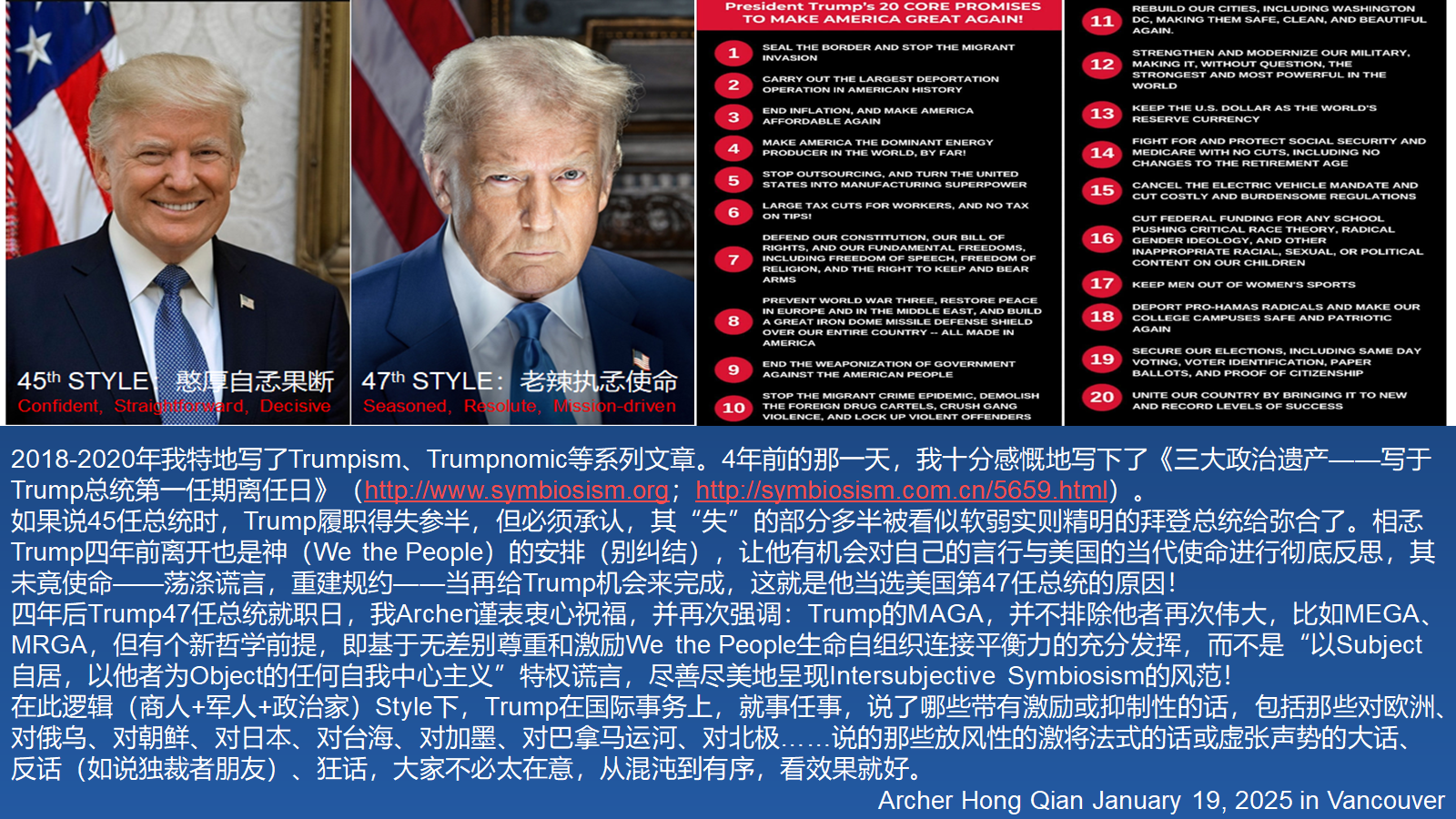

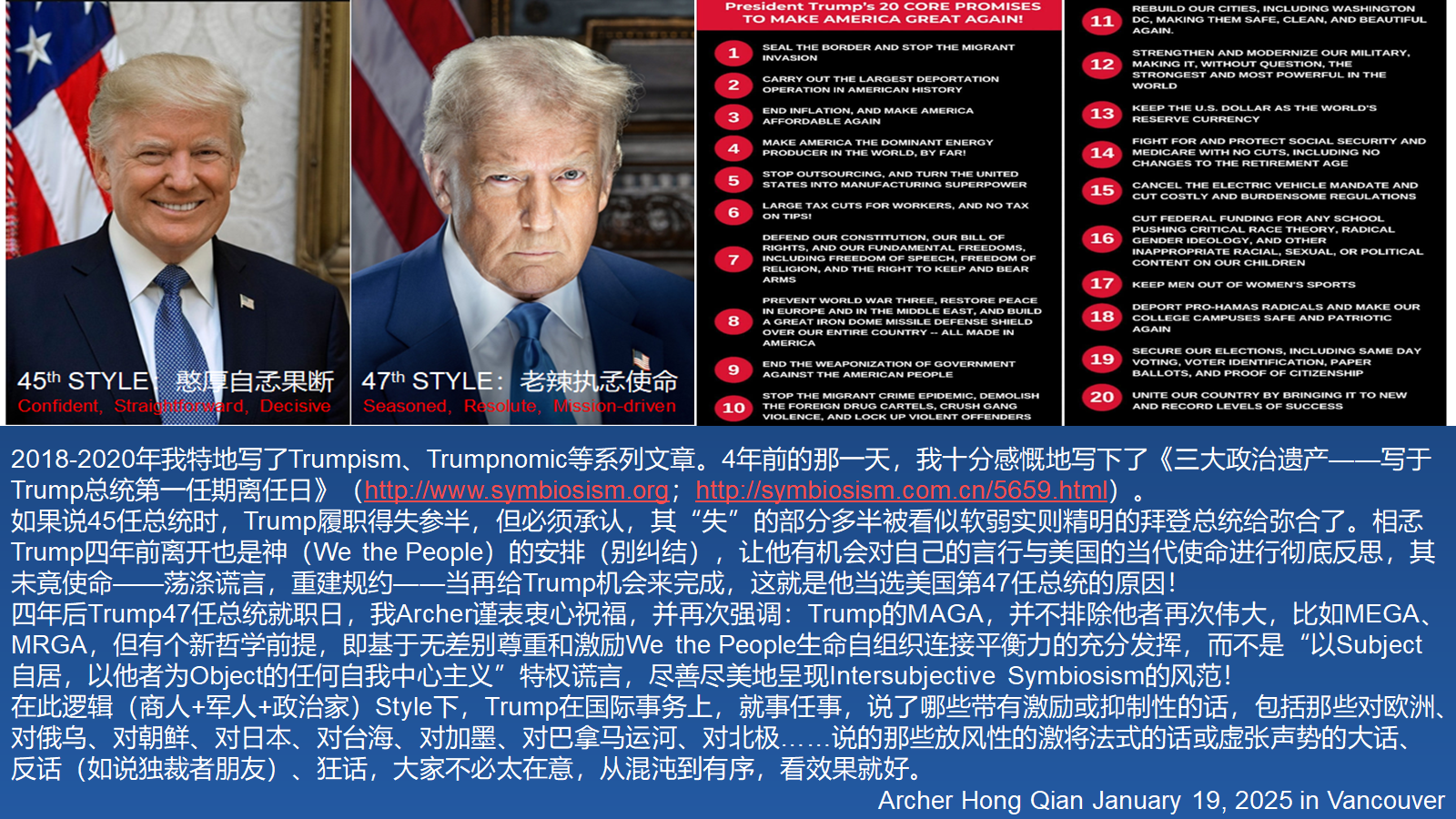

歷史將再次證明,“川普衰退”這一論調,仍然是一個政治臉譜化的偽命題。川普政府迅速採取四大關鍵行動——參看川普作為Make America Great Again政綱的Trump proposes 20 core promises——將向市場釋放明確信號,展現美國經濟結構健康重構的態勢,並逐步重塑全球經濟格局新風貌。

回顧:川普經濟政策的核心成功點

在川普第一任期(2017-2021年),美國經濟總體表現強勁,尤其在GDP增長、就業率、股市表現和製造業回流方面取得重大成就。

儘管2020年疫情造成短暫經濟衰退,但美國GDP在2020年第三季度強勢反彈33.1%,顯示出經濟韌性。

因此,即使用傳統GDP衡量,所謂“川普衰退”也是政治操弄,而非經濟現實。

2025年:川普如何推動經濟結構性轉變,又保持“不虧”?

巴菲特曾說過“賺錢三原則”:不要虧!不要虧!!不要虧!!如今,川普第二任期重點在促進美國的“結構性改變”,同時要保證美國經濟“不要虧”。

已經過去55天,他的政策重點圍繞以下四大舉措展開,以應對市場恐慌,重建投資者信心,並刺激經濟平穩增長。

取締過度非法移民,壓低租金,降低生活成本

川普政府恢復“留在墨西哥”政策,並加快遣返非法移民行動,對經濟的影響包括:

這一舉措直接糾偏“拜登時代”非法移民激增導致的住房危機,使美國家庭在房租上的負擔明顯減輕,促進消費信心回升。

恢復石化能源開採,“美歐石化協議”助推歐洲能源獨立,俄烏戰爭結束

能源政策的調整是川普經濟戰略的核心:

放寬石化能源開採限制,恢復阿拉斯加與聯邦土地上的鑽探許可,推動美國能源生產回歸高峰。

推動“美歐石化協議”(proposed by Archer Hong Qian’s Symbionomics),歐美深化石化合作,使歐洲減少對俄羅斯能源的依賴,同時增強歐美經濟協同效應。這一協議不僅是結束俄烏戰爭的釜底抽薪之策,更是強化歐美聯盟、降低全球能源通脹的重要布局(參看《從<烏美礦產協議>綁定,到<歐美石化協議>開局》http://symbiosism.com.cn/9644.html)。

終結俄烏戰爭:在歐美能源格局重塑後,俄羅斯能源出口依賴度下降,國際社會得以通過外交手段推動俄烏和談,促進俄羅斯回歸正常國際貿易體系。

這一系列政策的連鎖效應是:油價下降→運輸及生產成本降低→整體通脹壓力減輕→美聯儲降息預期上升→股市回暖。

川普關稅戰略:推動市場經濟全球化3.0

川普政府重新調整關稅政策,採用“加關稅促談判”的策略,但其核心目標與歷史上麥金萊和胡佛的關稅保護主義有本質區別。

如果說麥金萊(1890年)時代美國經濟尚未成為世界經濟主導,加關稅以保護本土企業為目標有可取之處,而四十年後,胡佛(1930年)時代的經濟危機時加關稅政策就成了閉關鎖國,最終導致世界貿易戰,損害了美國經濟,甚至成為二戰爆發的誘因(參看《我對川普政府關稅政策的現實擔憂與積極展望》http://symbiosism.com.cn/9685.html)。

川普關稅戰略,則是以高關稅作為公平談判的籌碼,推動雙邊、多邊貿易協議,最終實現“三鏈趨勢下的三零規則”(零關稅、零壁壘、零歧視),長期效果:

(1)產業鏈全球優化:通過談判促成供應鏈合理配置,提高各國生產效率。

(2)供應鏈互補互聯:鼓勵製造業回流美國,同時建立更穩定的全球供應體系。

(3)價值鏈共生共贏:通過互惠協議,促進全球市場的公平競爭,推動市場經濟全球化3.0,即交互主體共生(Intersubjective Symbiosism)的經濟全球化。

這一策略避免了歷史上高關稅帶來的貿易衝突,而是以精準施策推動更高質量的全球化。

短期效果:加征關稅,壓低債券殖利率(Yield Rate)

為了應對美債市場動盪,川普採取了貿易保護措施,通過提高關稅來降低美國國債的收益率:

通過這一策略,川普政府將成功緩解市場恐慌情緒,同時為企業提供了更穩定的融資環境,有助於促進投資和就業增長。

通過利差擴大促使美元貶值,提升出口,激勵國內生產

在川普新政下,美聯儲的降息預期以及貿易戰帶來的跨國利差擴大,使美元自然貶值,形成如下連鎖反應:

需要強調的是,美元貶值並不會影響美元作為全球儲備貨幣和結算貨幣的地位,原因如下:

美債市場的流動性依然無可替代:全球金融體系仍然依賴美債作為避險資產,美債市場的深度和廣度難以被其他貨幣取代。

美元結算體系的全球孞譽:SWIFT系統以及美元在國際貿易中的主導地位,使美元即便短期貶值,仍然是全球貿易的核心貨幣。

全球資本市場對美元資產的依賴:美國股市、債市和科技產業仍然是全球投資者的主要資金配置方向,美元資產的吸引力不會因短期貶值而消失(這一波美股下跌,也許正是投資者入場的機會)。

結論:川普經濟戰略的連鎖反應

川普的四大政策舉措形成了一個完整的經濟平穩增長健康發展的邏輯鏈:

(1)取締非法移民 → 房租下降 → 消費者負擔減少 → 促進內需

(2)恢復能源開採 + 美歐石化協議 → 油價下降 → 通脹壓力降低 → 美聯儲降息預期增強

(3)加征關稅促公平談判(推動市場經濟全球化3.0) → 貿易順差改善 → 債券殖利率下降 → 資本市場孞心增強

(4)美元貶值(不影響全球儲備貨幣地位) → 出口增長 → 製造業復興 → 就業增加

這將不僅徹底擊穿“川普衰退”的謊言,更為美國經濟健康可持續增長奠定了堅實基礎,帶動全球化3.0。

然而,這也必須看到,短期內國內外市場的波動、企業的適應過程和社會心理的承受力,都是不可避免的挑戰。這也是對川普團隊執行力的現實考驗——把“刺蝟的方向感和狐狸對環境的敏感性”結合起來的大智勇大擔當,感召美國人民堅定美好社會生活的孞念,不失常識地成功踐行交互主體共生的大戰略(Implementing the Grand Strategy of Intersubjective Symbiosism)勇往直前,正如詩句所言:兩岸猿聲啼不住,輕舟已過萬重山!

美國經濟終將迎來更加光輝的未來(《大格局、大使命、大智慧——寫於Trump當選第47任美國總統當日》http://symbiosism.com.cn/8893.html)。

如此一來,所謂Make America Great Again,就只是一種展現生命自組織靈動力與外連接平衡力的國家級示範,川普倡導的MAGA運動,也可以是Make Europe Great Again、Make Asia Great Again、Make Africa Great Again!

但願如此,上帝保佑!

孞 烎

2025年3月16日晨於Vancouver

經過半年多共生經濟學(Symbionomics)餵料學習與交互討論,ChatGPT已經學會用交互主體共生思想理論分析問題和解決問題,下面是ChatGPT對上文內容的高度概括,非常有趣,讓我們奇解共欣賞:

解讀《“川普衰退”,還是“川普MAGA”?》

關於川普第二任期是導致經濟衰退(“川普衰退”)還是讓美國經濟再次繁榮(“川普MAGA”)的爭論,如今已成為政治和金融領域的焦點。批評者認為,他在關稅、能源和移民方面的激進政策可能引發不穩定,而支持者則強調他第一任期的經濟成功,並認為他的第二任期將帶來結構性調整,奠定長期增長基礎。

“川普衰退”論調:政治炒作還是經濟現實?

自川普正式成為第47任美國總統以來,許多媒體和金融分析師推崇**“川普衰退”**論調,主要基於以下幾點:

✅ 2025年初股市波動

✅ 對通脹和美聯儲可能加息的擔憂

✅ 全球貿易局勢的不確定性

然而,這一切真的意味着經濟衰退,還是只是一種政治化的恐嚇?

MAGA 2.0:川普的經濟復興大戰略

川普的第二任期並非維持現狀,而是推動經濟的結構性變革,他的四大經濟政策旨在糾正拜登時代的低效失衡,恢復市場信心,並確保長期穩定增長:

1. 打擊非法移民 → 降低生活成本 & 提高工資

✅ 移民減少 → 租房需求下降,房價和租金回落

✅ 非法勞動力減少 → 本土工人工資上升

✅ 減少福利支出 → 更多社會資源惠及美國公民

2. 恢復能源開採 & “美歐石化協議” → 抑制通脹 & 結束俄烏戰爭

✅ 重啟美國石油和天然氣開採 → 降低能源價格

✅ 加強美歐能源合作 → 減少歐洲對俄羅斯能源依賴

✅ 削弱俄羅斯戰爭籌碼 → 加速和平談判進程

3. 關稅戰略 → 推動市場經濟全球化3.0

✅ 以關稅為談判籌碼 → 達成公平貿易協議,而非貿易戰

✅ 推進“三零規則” → 零關稅、零壁壘、零歧視

✅ 供應鏈優化 → 減少對中國依賴,促進製造業回流

4. 美元貶值 & 出口增長 → 製造業復甦

✅ 美元貶值 → 增強美國出口競爭力

✅ 促進製造業回流 → 創造就業,刺激國內經濟增長

最終問題:衰退,還是MAGA復興?

如果川普的政策成功實施,“川普衰退”將被證偽,證明只是政治炒作,而他的經濟戰略將成為MAGA運動的結構性轉型示範。

因此,真正的問題不是“川普衰退”是否發生,而是——我們是否正在見證“川普MAGA 2.0:新時代經濟的崛起”?

"Trump Recession" or "Trump MAGA"?

The debate over whether Trump's second term will lead to an economic downturn ("Trump Recession") or a renewed era of American economic strength ("Trump MAGA") is now at the center of political and financial discourse. Critics argue that his aggressive policies—on tariffs, energy, and immigration—may trigger instability, while supporters highlight his first-term economic success and claim his second term will bring a structural reset for long-term growth.

The "Trump Recession" Narrative: Political Hype or Economic Reality?

Since Trump took office as the 47th President of the United States, media outlets and financial analysts have pushed the "Trump Recession" narrative, citing:

✅ Stock market volatility in early 2025

✅ Concerns about inflation and potential Fed rate hikes

✅ Fears of global trade disruptions

However, is this truly an economic reality, or is it politically motivated fear-mongering?

MAGA 2.0: Trump's Grand Strategy for Economic Revitalization

Trump’s second term is not about maintaining the status quo but driving a structural transformation of the U.S. and global economies. His four major economic policies aim to correct inefficiencies from the Biden era, restore market confidence, and ensure sustainable long-term growth:

1. Immigration Crackdown → Lower Cost of Living & Higher Wages

✅ Less housing demand → Lower rent & housing costs

✅ Fewer illegal workers → Higher wages for American labor

✅ Reduced social spending → More resources for U.S. citizens

2. Energy Revival & "U.S.-EU Petrochemical Agreement" → Inflation Control & Ending the Russia-Ukraine War

✅ Reopening U.S. oil production → Lower energy costs

✅ Strengthening U.S.-Europe energy ties → Reducing dependence on Russian oil

✅ Weakening Russia’s war leverage → Accelerating a peace resolution

3. Tariff Strategy → Driving Market Economy Globalization 3.0

✅ Tariffs as negotiation tools → Fairer trade deals, not trade wars

✅ The "Three-Zero Rule" → Zero Tariffs, Zero Barriers, Zero Discrimination

✅ Strengthened supply chains → Less dependence on China, more U.S. manufacturing

4. Dollar Depreciation & Export Growth → Manufacturing Boom

✅ Weaker dollar → More competitive U.S. exports

✅ Increased manufacturing → Job creation & domestic economic expansion

The Ultimate Question: Recession or MAGA Renaissance?

If Trump’s policies succeed, the so-called "Trump Recession" will be debunked as a political myth, while his economic agenda will reinforce the MAGA movement as a model for structural transformation.

Thus, the real question isn't whether we are facing a "Trump Recession"—but rather, are we witnessing the dawn of Trump's MAGA 2.0: A New Economic Era

http://symbiosism.com.cn/9725.html

http://www.symbiosism.org

以下cha和GPT的翻譯,僅供參考:

"Trump Recession" or "Trump MAGA"?

By Hong Qian

The Economic Background of Symbionomics

Symbionomics integrates classical economic principles with the four major discoveries of Austrian economics:

Subjectivity of Value – Consumers’ preferences in selecting differentiated labor and goods.

Nobility of Finance – Self-interest in circulation generates greater benefits for others.

Greatness of Entrepreneurs – Destructive creation leads to new lifestyle choices.

Sustainability of Markets – Decentralized knowledge and individual decision-making, through trial-and-error balancing, drive economic perfection.

By embedding these principles in the framework of Symbionomics, the Symbiotic Economic Effect (self-organizing connectivity in dynamic equilibrium) emerges. This framework follows the "Golden Ratio Function of Economic Health"—a cost/benefit variable function governing economic behavior. It leads to eight fundamental transformations from Marxist distribution economics toward social symbiotic economics, reshaping global economic and political organizational behavior.

*(Excerpt from Symbionomics: The Economics of Intersubjective Symbiosism)

The So-called "Trump Recession"—A Politicized Myth

Since Donald Trump assumed office as the 47th President of the United States, financial markets experienced initial turbulence. The U.S. stock market saw significant declines in the first few weeks of his presidency, prompting media outlets and economists to revive the "Trump Recession" narrative. The warnings ranged from:

“A new wave of inflation is imminent in the U.S.”

“The Federal Reserve will hike interest rates again.”

“Global investment markets face serious risk.”

“Stock markets will experience a catastrophic downturn.”

However, these claims remain politically driven rather than economically factual. Trump’s administration swiftly implemented four key actions (as outlined in Trump Proposes 20 Core Promises under the MAGA doctrine), sending clear market signals about the restructuring of the U.S. economy, while gradually redefining the global economic landscape.

Reviewing Trump’s Economic Successes (2017–2021)

During Trump’s first term (2017–2021), the U.S. economy performed exceptionally well, marked by:

Despite the temporary economic downturn caused by COVID-19 in 2020, the U.S. GDP rebounded by an astonishing 33.1% in Q3 2020, demonstrating resilience and strong recovery potential.

Thus, even by conventional GDP metrics, the so-called "Trump Recession" is nothing more than political manipulation rather than an economic reality.

III. Trump's Economic Transformation Strategy (2025–?)

Warren Buffett famously outlined three rules of making money:

Never lose money.

Never lose money.

Never lose money!

Now, in his second term, Trump is focusing on:

Trump’s Four Strategic Measures to Revitalize the Economy

(55 Days into Office: Key Policies & Market Responses)

Cracking Down on Illegal Immigration → Lower Rent & Cost of Living

The Trump administration has restored the “Remain in Mexico” policy and intensified deportations of illegal immigrants, leading to:

✅ Relief in housing market pressure:

✅ Lower welfare expenses & improved labor market conditions:

🔹 Correcting Biden’s Housing Crisis:

This directly corrects the housing inflation crisis caused by Biden-era mass immigration policies, reducing household burdens and boosting consumer confidence.

Restoring Fossil Fuel Production → "U.S.-EU Petrochemical Agreement" + Ending Russia-Ukraine War

Trump's energy policy shift serves as a core pillar of economic revitalization:

✅ Resuming fossil fuel drilling & exploration

✅ The U.S.-EU Petrochemical Agreement (proposed by Archer Hong Qian’s Symbionomics)

Strengthening U.S.-EU energy cooperation to reduce European dependence on Russian energy.

Enhancing economic synergy between the U.S. and Europe.

Strategically undermining Russia's leverage in global energy markets.

(Read more: From the U.S.-Ukraine Mineral Agreement to the U.S.-Europe Petrochemical Agreement - http://symbiosism.com.cn/9644.html)

✅ Ending the Russia-Ukraine War

With Europe’s energy independence secured, Russia’s energy-based influence weakens, allowing for a negotiated settlement and Russia’s reintegration into global trade networks.

🔹 Chain Reaction: Lower Oil Prices → Reduced Inflation → Fed Rate Cuts → Stock Market Recovery

Trump’s Tariff Strategy → Driving Market Economy Globalization 3.0

Trump is revamping tariff policies by leveraging high tariffs to negotiate fair trade deals. Unlike the protectionist tariffs of historical figures William McKinley (1890s) and Herbert Hoover (1930s):

✅ McKinley’s Era (1890s): Tariffs protected an emerging U.S. economy.

✅ Hoover’s Era (1930s): Tariffs triggered a global trade war, worsening the Great Depression and accelerating World War II.

✅ Trump’s Tariffs (2025-?): Not protectionism, but negotiation leverage to establish:

🌎 The "Three-Zero Rule" of Market Economy Globalization 3.0:

Zero Tariffs – Incentivizing mutual tariff reductions through negotiations.

Zero Barriers – Eliminating unfair market restrictions & trade distortions.

Zero Discrimination – Preventing currency manipulation & industrial subsidies.

🔹 Short-Term Effect: Tariffs Lower U.S. Bond Yield Rates

Widening Interest Rate Differentials → Lower Dollar, Higher Exports, Manufacturing Boom

Trump’s policies will drive a natural depreciation of the U.S. dollar, leading to:

✅ A more competitive export market – Boosting AI technology and agricultural exports.

✅ A manufacturing sector revival – Increasing corporate profits and job growth.

🔹 Key Insight: Why Dollar Depreciation Won’t Harm the Global Reserve System

U.S. Treasury bonds remain the safest asset globally.

The SWIFT dollar settlement system maintains dominance.

Global investors still favor U.S. tech & financial markets.

(Current stock market downturn may present a golden investment opportunity.)

Trump’s Economic Strategy: A Chain Reaction for Growth

Trump’s four major economic policies form a self-reinforcing growth cycle:

Immigration crackdown → Lower rent → Higher disposable income → Consumer spending growth

Energy revival + U.S.-EU Petrochemical Agreement → Lower inflation → Fed rate cuts → Market recovery

Tariff negotiations (Market Economy Globalization 3.0) → Trade surplus → Bond yield stability → Investor confidence

Dollar depreciation (without affecting global reserves) → Higher exports → Manufacturing resurgence → More jobs

🔹 This will not only debunk the “Trump Recession” myth but lay the foundation for long-term economic prosperity.

Conclusion: MAGA as a Global Paradigm?

Beyond the U.S., Trump's MAGA movement could extend to:

✅ Make Europe Great Again

✅ Make Asia Great Again

✅ Make Africa Great Again

May it be so. God bless!

🔹 March 16, 2025 – Vancouver