Abstract

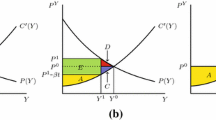

This paper examines the optimal environmental and monetary policy mix in a New Keynesian model embodying pollutant emissions, abatement technology and environmental damage. The optimal response of the economy to productivity shocks is shown to depend crucially on the instruments policy makers have available, the intensity of the distortions they have to address (i.e. imperfect competition, costly price adjustment and negative environmental externality) and the way they interact.

Similar content being viewed by others

Notes

According to observers, in fact, the recent 2030 Climate and Energy Policy Framework of the European Union would represent a sort of compromise between countries that rely heavily on coal and those willing to push even further the process of decarbonization. See European Council (2014) and European Commission (2014).

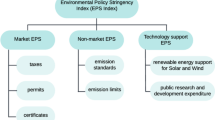

Starting from the seminal paper by Weitzman (1974) the debate on which environmental policies would best serve the goal of cutting GHG emissions has been going on in different modelling settings. See Goulder et al. (1999), Parry and Williams (1999), Dissou (2005), Hoel and Karp (2002), Kelly (2005), Newell and Pizer (2008), Quirion (2005), Jotzo and Pezzey (2007).

On the macroeconomic approach to environmental policy issues, see the survey by Fischer and Heutel (2013).

Nonetheless, the specific institutional set-up of the euro area, with centralized monetary policy and decentralized fiscal policy, renders the central bank commitment to control inflation even more challenging.

For the sake of parsimony, in fact, here we deliberately abstract from capital accumulation and opt to model nominal rigidities by introducing quadratic adjustment costs as an alternative to the Calvo-pricing, as instead was done in Annicchiarico and Di Dio (2015).

In this way, the costs introduced by price adjustments are neutralized. See e.g. Clarida et al. (2000), Woodford (2003) and Schmitt-Grohé and Uribe (2004). Exceptions are given by Faia (2008, 2009) who show that the optimality of fully inflation targeting does not hold when the basic New Keynesian model is extended along different dimensions.

See the “Appendix” for details.

In addition, when allowing for government borrowing and in the impossibility of using lump-sum taxes, it might be optimal for the government to use fiscal deficits (i.e. adjustments in the level of public debt) as shock absorber and, therefore, the welfare implications might differ. Although this is an important issue, we leave this aspect for future research.

The carbon cycle described by Eq. (15) in assuming that all existing stock of pollution depreciates at a constant rate and abstracting from carbon-circulation models simplifies the one adopted by Golosov et al. (2014), who instead assume a permanent and a temporary component of emissions along with a specific rule regarding the evolution of pollution from both components.

Notice that in the absence of environmental damage \(\lambda _{t}^{M}=0\) and \(U_{t}=0\), while condition (18) boils down into the familiar efficient condition equalizing the marginal rate of substitution between consumption and labor, \(\mu _{L}L_{t}{}^{\eta }C_{t},\) to the marginal rate of transformation, \(A_{t},\) implying that \(L_{t}=\left( \frac{1}{\mu _{L}}\right) ^{\frac{1}{1+\eta }},\) that is, at the optimum, labor is constant.

The model has been solved in Dynare. For details see http://www.cepremap.cnrs.fr/dynare/ and Adjemian et al. (2011)

For further details, see the Technical Appendix available from the authors upon request.

The RICE-2010 model is available for download at http://www.econ.yale.edu/~nordhaus/homepage/RICEmodels.htm. For a detailed description of the model, see Nordhaus and Boyer (2000).

In the absence of a damage function, in fact, under Pareto efficiency hours worked are constant, while consumption and output move proportionally to productivity.

See, e.g., Heutel (2012).

The steady state has been computed numerically using the ordinary least square approach proposed by Schmitt-Grohé and Uribe (2012). For further details, see the Technical Appendix.

We perform this sensitivity analysis so as to keep the steady-state level of the abatement cost per unit of output constant by changing the scale parameter \(\phi _{1}\) accordingly.

In this setting, under a Ramsey environmental policy, the existence of a unique stable equilibrium requires that the policy parameter governing the reaction of the nominal interest rate to inflation, \(\rho _{\Pi },\) is less than one. For values larger than one, in fact, the model becomes unstable.

References

Adjemian S, Bastani H, Juillard M, Mihoubi F, Perendia G, Ratto M, Villemot S (2011) Dynare: reference manual, version 4. Dynare working papers no. 1, CREPEMAQ

Angelopoulos K, Economides G, Philippopoulos A (2013) First-and second-best allocations under economic and environmental uncertainty. Int Tax Public Finance 20:360–380

Annicchiarico B, Di Dio F (2015) Environmental policy and macroeconomic dynamics in a new Keynesian model. J Environ Econ Manage 69:1–21

Bosetti V, Maffezzoli M (2014) Occasionally binding emission caps and real business cycles. IGIER working papers 523, Bocconi University

Clarida R, Gali J, Gertler M (2000) Monetary policy rules and macroeconomic stability: evidence and some theory. Q J Econ 115:147–180

Dissou Y (2005) Cost-effectiveness of the performance standard system to reduce \({\rm CO}_{2}\) emissions in Canada: a general equilibrium analysis. Resour Energy Econ 27:187–207

European Commission (2014) Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee of the Regions—Energy prices and costs in Europe—COM(2014) 21 /2

European Council (2014) Conclusions on 2030 climate and energy policy framework, SN 79/14

Faia E (2008) Ramsey monetary policy with capital accumulation and nominal rigidities. Macroecon Dyn 12:90–99

Faia E (2009) Ramsey monetary policy with labor market frictions. J Monet Econ 56:570–581

Fischer C, Heutel G (2013) Environmental macroeconomics: environmental policy, business cycles, and directed technical change. Annu Rev Resour Econ 5:197–210

Fischer C, Springborn M (2011) Emissions targets and the real business cycle: intensity targets versus caps or taxes. J Environ Econ Manage 62:352–366

Galí J (2009) Monetary policy, inflation, and the business cycle: an introduction to the new Keynesian framework. Princeton University Press, Princeton

Ganelli G, Tervala J (2011) International transmission of environmental policy: a new Keynesian perspective. Ecol Econ 70:2070–2082

Golosov M, Hassler J, Krusell P, Tsyvinski A (2014) Optimal taxes on fossil fuel in general equilibrium. Econometrica 82:41–88

Goulder LH, Parry IWH, Williams RC III, Burtraw D (1999) The cost-effectiveness of alternative instruments for environmental protection in a second-best setting. J Public Econ 72:329–360

Heutel G (2012) How should environmental policy respond to business cycles? Optimal policy under persistent productivity shocks. Rev Econ Dyn 15:244–264

Hoel M, Karp L (2002) Taxes versus quotas for a stock pollutant. Resour Energy Econ 24:367–384

Kelly DL (2005) Price and quantity regulation in general equilibrium. J Econ Theory 125:36–60

Jotzo F, Pezzey JCV (2007) Optimal intensity targets for greenhouse gas emissions trading under uncertainty. Environ Resour Econ 83:280–286 A: MIT Press

Leeper EM (1991) Equilibria under active and passive monetary and fiscal policies. J Monet Econ 27:129–147

Newell RG, Pizer WA (2008) Indexed regulation. J Environ Econ Manage 56:221–233

Nordhaus WD (2008) A question of balance: weighing the options on global warming policies. Yale University Press, New Haven

Nordhaus WD, Boyer J (2000) Warming the world: economic models of global warming. MIT Press, Boston

Parry IWH, Williams RC III (1999) Second-best evaluation of eight policy instruments to reduce carbon emissions. Resour Energy Econ 21:347–373

Quirion P (2005) Does uncertainty justify intensity emission caps? Resour Energy Econ 27:343–353

Rotemberg J (1982) Monopolistic price adjustment and aggregate output. Rev Econ Stud 44:517–531

Schmitt-Grohé S, Uribe M (2004) Optimal fiscal and monetary policy under sticky prices. J Econ Theory 114:198–230

Schmitt-Grohé S, Uribe M (2007) Optimal simple and implementable monetary and fiscal rules. J Monet Econ 54:1702–1725

Schmitt-Grohé S, Uribe M (2012) An OLS approach to computing Ramsey equilibria in medium-scale macroeconomic models. Econ Lett 115:128–129

Smets F, Wouters R (2007) Shocks and frictions in US business cycles: a Bayesian DSGE approach. Am Econ Rev 97:586–606

Weitzman ML (1974) Prices vs quantities. Rev Econ Stud 41:477–491

Woodford M (2003) Interest and prices: foundations of a theory of monetary policy. Princeton University Press, Princeton

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to two anonymous referees for their insightful comments and suggestions on an earlier version of the paper. The views expressed herein are those of the authors and not necessarily reflect those of Sogei S.p.A.. This paper has previously circulated under the title “Ramsey Monetary Policy and GHG Emissions Control”.

Appendix

Appendix

1.1 Derivation of the New Keynesian Phillips Curve

The Lagrangian function of the generic j firm’s problem is

where \(Q_{t,t+i}^{R}\) is real stochastic discount factor, which is related to the household discount factor \(\beta \) and the marginal utility of real wealth \(\lambda _{t}\) by the formula \(Q_{t,t+i}^{R}=\beta ^{i}\frac{\lambda _{t}}{\lambda _{t+i}},\) and \(\Psi _{j,t}\) is the Lagrange multiplier of constraint (1). Differentiating the above expression with respect to \(L_{j,t} \), \(U_{j,t}\) and \(P_{j,t},\) using the fact that \(Y_{j,t+i}=\left( \frac{P_{j,t}}{P_{t}}\right) ^{-\theta }Y_{t+i}\) for \(i=0,1,2,3,\dots ,\) gives:

This last condition can be re-written as

where \(MC_{j,t}=\phi _{1}U_{j,t}^{\phi _{2}}+p_{Z,t}\left( 1-U_{j,t}\right) \varphi +\Psi _{j,t}.\)

Imposing symmetry across firms and simplifying, (5)–(7) immediately follow.

1.2 Ramsey Monetary and Environmental Policy

The Lagrangian function associated to the Ramsey problem is

where \(\lambda _{t}^{\Pi }\), \(\lambda _{t}^{M}\) and \(\lambda _{t}^{C}\) are the Lagrange multipliers.

The first-order conditions (FOC) relative to the variables \(R_{t},\) \(L_{t}\), \(U_{t}\), \(\Pi _{t}\), \(M_{t}\) are the following.

which implies that \(\lambda _{t}^{C}=0\). Therefore, we can neglect this constraint which is never binding when the Ramsey planner controls \(R_{t}.\)

It should be noted that the above first-order conditions are optimal from a “timeless perspective”, rather than from the perspective of the particular date at which the policy is actually adopted.

In steady state the FOC with respect to inflation \(\Pi _{t}\) (36) simplifies to:

Since \(\lambda ^{\Pi }>0\) it must be that in steady state \(\Pi =1,\) that is Ramsey optimal steady-state inflation rate is zero.

1.3 Ramsey Monetary Policy and Environmental Regulations

When GHG emissions control policy is given by a carbon tax, and the Ramsey planner controls monetary policy, the first-order conditions relative to the variables \(R_{t},\) \(L_{t},\) \(\Pi \) \(_{t},\) \(M_{t}\) are the following:

which implies that \(\lambda _{t}^{C}=0\). Thefore, we can neglect this constraint which is never binding when the Ramsey planner controls \(R_{t}\).

Under a cap-and-trade scheme the first-order conditions with respect to \( R_{t}\) and \(\Pi _{t}\) are equivalent to (33) and (41), while the remaining optimal conditions relative to \(L_{t},\) \(U_{t},\) \(M_{t}\) read as follows

with \(\lambda _{t}^{Z}\) being the Lagrange multiplier associated to the constraint \(Z=\left( 1-U_{t}\right) \varphi A_{t}L_{t}.\)

1.4 Ramsey Environmental Policy and Interest-Rate-Rules

When then Ramsey planner controls environmental policy, but takes as given monetary policy which is conducted according to an interest-rate rule of the type (24), the optimal conditions read as follows:

where \(\lambda _{t}^{R}\) is the Lagrange multiplier associated to the interest-rate rule (24).

Rights and permissions

About this article

Cite this article

Annicchiarico, B., Di Dio, F. GHG Emissions Control and Monetary Policy. Environ Resource Econ 67, 823–851 (2017). https://doi.org/10.1007/s10640-016-0007-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-016-0007-5