Data sourced from the Bureau of Economic Analysis and the Census Bureau.

Manufacturing inputs are classified as all goods that fall under the capital goods, industrial supplies, and auto parts end use categories.

Trade

Trading to Win

Manufacturers are offering a clear, actionable agenda to strengthen U.S. manufacturing through common-sense trade policy:

-

1

Go for Zero-for-Zero Tariffs

We’re calling on negotiators to secure better terms for manufacturers by adopting zero-for-zero tariffs for American-made products in our trading partners’ markets. That means they don’t charge us, and we don’t charge them.

-

2

Protect Inputs That Power U.S. Production

More than half of U.S. imports are manufacturing inputs. These include critical minerals, chemicals and machinery essential for making things in America. On the path to zero-for-zero, we urge negotiators to take out of scope specific manufacturing inputs we need to make things in America.

-

3

Create American Investment Incentives

If tariffs remain in place, we propose specific incentives, such as tariff rebates for manufacturing companies investing in manufacturing in the U.S. to accelerate the growth of the American industrial base.

Trade Intelligence Center

Key Facts

Manufacturers across America will see a rise in the cost of intermediate input products from tariffs

1State manufacturing output figures derived from 2023 regional data tables produced by the Bureau of Economic Analysis. 2Percentage of intermediate manufacturing inputs sourced from outside the U.S. derived from U.S. EPA's StateIO - Open Source Economic Input-Output Models for the 50 States of the United States of America and USA Trade Import Destination by State, 2023 tables. Li, M., J. Ferreira, C. Court, D. Meyer, M. Li, AND Wesley W. Ingwersen. StateIO - Open Source Economic Input-Output Models for the 50 States of the United States of America. International Regional Science Review. SAGE Publications, THOUSAND OAKS, CA, 46(4):428-481, (2023). https://doi.org/10.1177/01600176221145874 3Average increase in effective tariff rate is computed from the difference of the average effective tariff rate due on manufacturing inputs between Dec.31, 2024 and Apr.30, 2025. 4Average manufacturing gross margin is computed from 2021 U.S. Census Bureau Annual Survey of Manufacturers data and is calculated as 1 - ((Payroll + Cost of Materials)/Revenue)

What Manufacturers Are Saying on Tariffs

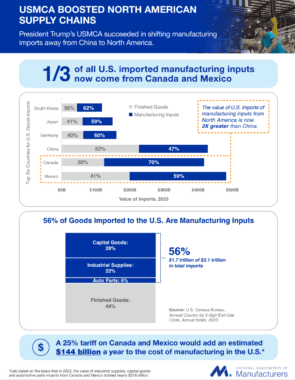

The Promise of the USMCA

President Trump’s USMCA succeeded in shifting manufacturing imports away from China to North America. In this new phase of U.S. trade policy, strengthening the United States–Mexico–Canada Agreement will be critical in helping North America restore balance and combat disruptive, problematic trade practices coming out of other countries, specifically China.

View and download the NAM’s new one pager that assesses the impact and value of U.S imports of manufacturing inputs from North America.