ASX rises and Aussie dollar falls as RBA opens door to more rate cuts after 0.25 percentage point reduction

Markets are betting on further interest rate cuts to come, after the Reserve Bank took the knife to the cash rate at its May meeting.

The Australian dollar fell on Tuesday afternoon, in the wake of the RBA's 0.25 percentage point cut.

Meanwhile, the local share market closed higher, with the ASX 200 and All Ordinaries both adding 0.6 per cent.

While markets had almost entirely priced in the quarter of a percentage point cut to 3.85 per cent in May, the board's post-meeting statement was considered more dovish than some had expected.

"The RBA remains 'cautious about the outlook', but its overall commentary appears more dovish leaving the door wide open for further easing but in no rush unless the tariff threat escalates," AMP chief economist and head of investment strategy Shane Oliver said.

"We expect the RBA to cut again in August, November, and February next year taking the cash rate to 3.1 per cent.

"There is now close to a 50 per cent probability of another cut as early as July though."

'Cautious cut' leaves RBA room to move

At her post-meeting press conference, RBA governor Michele Bullock said the board had weighed up the possibility a 0.50 percentage point cut, before consensus was reached on 0.25 of a percentage point.

"Does it mean we're headed into a long series of interest rate cuts? I don’t know at this point and that's why I think the cautious 25-basis-point cut with a recognition that if we need to move quickly, we can. We have got space."

According to LSEG data, market pricing shifted towards a 60 per cent probability of another cut in July, with a 0.25 percentage point reduction fully priced in by August, and a 3.1 per cent cash rate seen as the likely end point this cycle.

Look back on how the market reaction to the interest rate cut played out, plus coverage of the RBA decision as it happened, with insights from our specialist business reporters.

Disclaimer: this blog is not intended as investment advice.

Submit a comment or question

Live updates

That's it from us

That will be it from us today. Thanks for joining us.

Thank you to everyone who sent comments into the blog. We're sorry that we couldn't respond to all of them. There were a lot.

If you join us back here tomorrow we'll have more post-rate cut analyses and stories to share with you.

Until tomorrow, take care of yourselves.

RBA has become more 'dovish'

Shane Oliver, AMP Capital chief economist, has circulated a note on the RBA's cut rate.

He summarises things this way:

- The RBA cut by 0.25% taking its cash rate to 3.85%. This is the second rate cut in this easing cycle.

- The RBA remains “cautious about the outlook”, but its overall commentary appears more dovish leaving the door wide open for further easing but in no rush unless the tariff threat escalates.

- We expect the RBA to cut again in August, November, and February next year taking the cash rate to 3.1%. There is now close to a 50% probability of another cut as early as July though.

- The ongoing rate cutting cycle should help underpin a modest further pick up in Australian economic growth to around 1.8% year-on-year, but with the tariff threat posing a big downside risk.

For households with mortgage repayments, he has calculated how much extra money those households will still be paying in repayments compared to before the rate hiking cycle began in May 2022.

"The latest cut means that just two of the 13 rate hikes between May 2022 and November 2023 which totalled 4.25% have been reversed," he says.

"For mortgage payments it will reverse another $1,260 of the $16,800 increase in annual payments on a $660,000 since May 2022. Or a total saving of $2,520, which still only reverses 15% of the increase in payments since May 2022."

That calculation really does illustrate how, in Australia, so much of the "heavy lifting" in the fight against inflation falls on households with mortgages.

Oliver also says the RBA appears to have become "progressively more dovish" since its February meeting.

"The RBA is no longer referring to a further tightening in the labour market, nor is it referring to the risks of easing “too much too soon”, it now sees underlying inflation back at target, it sees the risks to inflation as having become “more balanced” and its now more concerned about the threat posed by the US tariffs and sees this as being disinflationary for Australia," he says.

"And as in April, RBA Governor Bullock is no longer pushing back against market expectations for further easing as was the case in February.

"The RBA reiterated that it will “be attentive to the data and the evolving assessment of risks”, but overall, it appears to be leaving the door open for further easing."

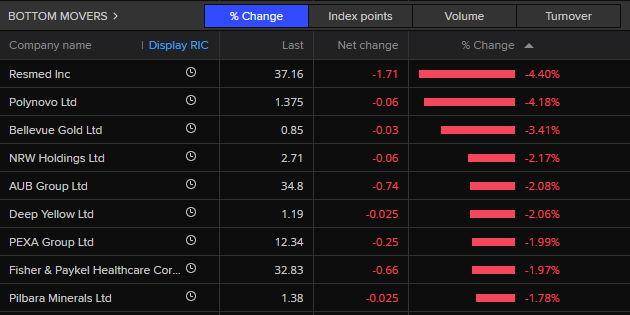

Best and worst performers

Among the top performing individual stocks on the ASX today were TechnologyOne (up $3.74, +11.33%, to $36.76), Clarity Pharmaceuticals (up 11 cents, +5.05%, to $2.29) and Domino's Pizza (up 96 cents, +3.91%, to $25.51).

Among the worst performing stocks were Resmed (down $1.71, -4.41%, to $37.16), AUB Group (down 74 cents, -2.08%, to $34.8), and Fisher & Paykel Healthcare (down 66 cents, -1.97%, to $32.83).

'Not unreasonable to expect two to three more interest rate cuts this year'

Market pricing for further interest rate cuts increased after the May decision, with about a 50 per cent chance of another quarter of a percentage point reduction at the next meeting in July, according to LSEG data.

Betashares chief economist David Bassanese has forecast two more interest rate cuts this year, to take the cash rate to 3.35 per cent.

"With underlying inflation expected to fall to the mid-point of the target band, there remains a strong case for the RBA to continue to process of 'normalising' interest rates [by] reducing them from still restrictive levels," he wrote.

"If inflation falls to normal levels, so should interest rates."

While Mr Bassanese noted the potential for more cuts if the global tariff uncertainty hits global and local economic growth more than anticipated, but said it was not his base case.

"The openness of the Trump Administration to lower tariffs in exchange for trade deals has been a major development in recent weeks, and should be enough to avoid the US tumbling into a serious recession.

"But if the US does fall into recession, the RBA could easily cut rates into expansionary territory — as far as 2 per cent or even lower."

CreditorWatch chief economist Ivan Colhoun described it as "a more dovish easing" by the central bank.

"The accompanying forecasts and commentary reflect greater anticipated negative effects of US tariff policy and related uncertainties than I had expected … there remains significant uncertainty around the final scope of US tariff policy," he said.

"It's not unreasonable to expect two to three more interest rate cuts this year."

Mr Colhoun noted that the RBA's updated forecasts, which has incorporated the anticipated negative effect of tariffs, assume two further cuts to the cash rate.

"Tariff effects have seen the RBA trim its forecast recovery in GDP growth, raise its unemployment forecast very slightly, and reduce its inflation forecasts to a broadly at target 2.6 per cent throughout the forecast horizon."

Lenders who have cut variable home loan rates so far...

As reported below, the big four banks have all passed on the Reserve Bank's 0.25 percentage point rate cut.

According to comparison site Canstar, these are all the lenders who have passed on the rate cut to home loan customers.

Macquarie Bank will also pass on the 0.25 percentage point cut for their variable home loan reference rates from 23 May (but we haven't seen what their new lowest advertised variable rate will be).

You can read more detail about interest rates here:

ASX closes 0.58pc higher

Trading has finished on the stock exchange today, and the ASX200 index has gained 48.2 points (+0.58%) to close on 8.343.3 points.

Victoria's mega-budget and the cuts to come

Hi team,

Here's what's in Victoria’s budget for the coming year (having been locked up looking at the books for several hours today).

Debt is set to balloon to record levels as the state government battles to rein in spending.

The axe looms over thousands of public sector jobs. At this stage it's 1,200 full time roles - but many of them are jobs that have expired not people that are currently filling them.

But up to 3,000 full-time employees are in the frame, with a review due in June.

Treasurer Jaclyn Symes' first state budget reveals net debt will reach $167.6 billion dollars this year, before growing to an eye-watering $194 billion dollars in three years’ time.

It will see the state pay $7.6 billion in interest this year – or $20.7 million a day. Those repayments will jump to $10.6 billion dollars annually or $29 million a day in three-years' time.

Is the RBA worried about the effect of rate cuts on house prices?

In its Statement on Monetary Policy, the Reserve Bank said that housing prices had yet to "materially respond" to easier borrowing conditions, i.e. lower interest rates.

So I asked RBA governor Michele Bullock whether that gave the board more comfort to lower interest rates further.

"Our focus has to be on inflation and, if it's the right thing to do in terms of employment and inflation is to lower interest rates, I think we have to accept what that might imply for housing because, as I said earlier, the issue for housing is supply and demand," she responded.

"And if we start thinking about, 'Well, do we lower interest rates because of housing prices?' we're going to take our eye off the ball, which is inflation, unemployment. And I don't think that would be the right thing to do.

"So I acknowledge that some people are worried that as interest rates come down, housing prices will rise.

"But other policies are really going to have to step up here and address what is a housing shortage."

Watch: RBA Governor Michele Bullock

RBA Governor Michele Bullock says despite inflation easing, there is uncertainty about global growth due to the US tariffs.

You can watch more here:

Loading...Should we expect house prices to take off?

Tim Lawless, the research director for Cotality (formerly CoreLogic), says the RBA's rate cut will support housing markets.

However, he says people shouldn't expect a boom in housing prices until affordability improves.

He says borrowers are likely to benefit from the rate cut through lower mortgage rates, and the rate cuts should lift consumer confidence (because historically, rate cuts have tended to boost sentiment).

He says that combination of lower interest rates and improved sentiment is likely to support increased activity in the housing sector, given there is generally a correlation between consumer sentiment and home sales volumes.

"We may also see continued upward pressure on housing prices, extending the broad-based recovery in values that began after the February rate cut," he says.

But having said that, he said we shouldn't expect a "significant acceleration in capital gains."

"Several factors continue to constrain price growth, including stretched affordability, cautious lending practices, and the reality that despite 50 basis points of easing, interest rates remain in restrictive territory," he says.

"While lower rates should help to make housing more accessible, further upward pressure on prices would offset the benefits of improved loan serviceability.

"Each of the four housing affordability metrics published by Cotality were either at record highs or equal record highs at the end of last year, a reminder of the challenges many prospective home buyers face," he says.

Watch: Treasurer speaks about the rate cut

Treasurer Jim Chalmers says the RBA's rate cut shows progress in bringing down inflation.

You can watch the Treasurer speaking here:

Loading...Is there a risk that there won't be further rate cuts?

A question from my colleague David Chau about the threat of a renewed inflation break-out.

RBA governor Michele Bullock says that threat seems to have eased, but hasn't disappeared.

"We have gone a little more comfortable, just a little more comfortable, that things are going in the right direction, so we can take the brake off a little bit more."

Hence why the RBA felt comfortable cutting the cash rate to 3.85% today.

RBA board discussed a 0.50 percentage point cut

RBA governor Michele Bullock says the 0.25 percentage point cut was a "consensus decision" but that the board did discuss a double rate cut.

"What the board discussed was two options. Hold, or lower. There was a bit of discussion about hold and that was put aside fairly quickly.

"The discussion then was about cut and how big and there was a discussion about 50 and 25 (basis points). The board was of the view that 25 was the right number to cut on this occasion," she said.

Ms Bullock said by focusing on the domestic economy and putting aside the international situation for a moment, they came to a conclusion.

"With inflation in the band and also unemployment doing pretty well, we think there is a bit of scope to lower interest rates. I know the board was of the view that 25 basis points was the right thing. For now, it doesn't rule out that we might need to take action in the future."

Macquarie Bank passes on rate cut

Following the big four banks, Macquarie Bank says it will also pass on the RBA's rate cut.

It says it will reduce its variable home loan reference rates by 0.25% per annum.

The change will be effective from 23 May 2025.

It says customers can view their new rate in Macquarie Online Banking or the Macquarie Mobile Banking app from 23 May 2025.

It says for customers paying both principal and interest, their first monthly repayment that falls within 30 days after 23 May 2025 will remain the same with repayments changing the following month. Customers paying interest only will have their first repayment after 23 May 2025 change.

RBA board never voted against staff recommendation

RBA governor Michele Bullock says there is usually a staff recommendation from the bank about what to do with monetary policy.

She can only speak to her time on the board but acknowledges that, in that time, the board has never voted against the RBA staff recommendation on rates.

RBA 'on alert' for 'cataclysmic event'

My colleague David Taylor asks RBA governor Michele Bullock if the Reserve Bank is "on alert" for a "cataclysmic event" on financial markets, given the uncertainty generated by the Trump administration's tariff policies.

"We are on the alert for that. And we're paid to worry about that sort of thing. And we have been watching that very closely, as have other central banks all around the world," the RBA boss responds.

"If you look at our scenario analysis, it does suggest that in a really bad outcome there would there could possibly be a recession, yes.

"But that's in the very extreme circumstance. And again, it was to try and give ourselves some sort of spectrum of outcomes that we might be looking at at the moment. We're not looking at that, but we need to be alert."

US tariffs likely to lower inflation here, but there are risks

An interesting comment on the inflationary impact of Donald Trump's tariffs from Michele Bullock in her opening remarks:

"One thing to keep in mind, we have made the judgement that global trade developments will overall be disinflationary.

"However, there is a risk to inflation on the upside, trade policies could lead to supply chain issues, which could raise prices for some imports, much as we saw during the pandemic.

"And so we'll also need to be alert to such upside risks."

Bullock is speaking now

Delivering her opening address, RBA governor Michele Bullock reiterates how important it was for the RBA to bring inflation down because it "hurts everyone".

However, she repeats that the RBA deliberately chose to take a "cautious approach" to raising interest rates to protect jobs.

Now, she says the job is to keep inflation where it is.

How the RBA's cash rate moved ahead of today's cut to 3.85%

Here's a look at how the RBA's cash rate got to where it is now, at 3.85 per cent after this afternoon's cut:

We're all waiting for RBA governor Michele Bullock

We're watching the door through which she'll come any minute...