- Bitcoin price holds above the $26,000 level, showing resilience in the face of the US regulator's clampdown on cryptocurrencies.

- BTC added nearly 50,000 millionaires to its list of holders since January 5.

- Bitcoin dominance climbed 19% since the beginning of the year, signaling a shift in market sentiment towards BTC.

The number of addresses that hold Bitcoin worth more than $1 million has increased significantly in 2023, reaching almost 50,000, as its price increased despite the US Securities and Exchange Commission’s (SEC) crackdown on the industry and a broader crypto winter.

Bitcoin and altcoins are braving the SEC’s lawsuit against Binance and Coinbase differently: while increasing regulatory scrutiny on exchanges led to capital outflows from altcoins, it also fueled Bitcoin’s rising dominance.

The US financial regulator’s actions have tested Bitcoin’s resilience, but the asset has held above the $26,000 level despite recent volatility in the crypto ecosystem.

Also read: XRP price climbs ahead of Hinman document release in SEC vs. Ripple case

Bitcoin creates 47,994 new millionaires in 2023

Bitcoin price sustained above a key level of $25,000 through the first half of 2023. Since the beginning of the year, the asset’s price climbed 59.7% against the US Dollar, according to data from Binance.

This price increase has been particularly profitable for 47,994 holders of the currency, whose Bitcoin holdings have surpassed the psychological value barrier of one million dollars.

Based on data from Bitinfocharts.com, on January 5 there were 28,084 BTC-holding wallet addresses worth upwards of $1 million, a number that has increased to 76,078. This marks an 170% increase in the number of wallets that turned millionaires with their Bitcoin holdings.

Bitcoin wallet addresses worth $1,000,000 or higher as seen on Bitinfocharts.com

The above chart reveals a significant increase in the number of wallet addresses richer than $1,000,000. This fuels a bullish thesis for Bitcoin despite the regulatory clampdown on the asset by US regulators.

Bitcoin dominance climbs 19% since the beginning of 2023

Another key metric supporting a bullish thesis for Bitcoin is the rising dominance of the largest asset by market capitalization.

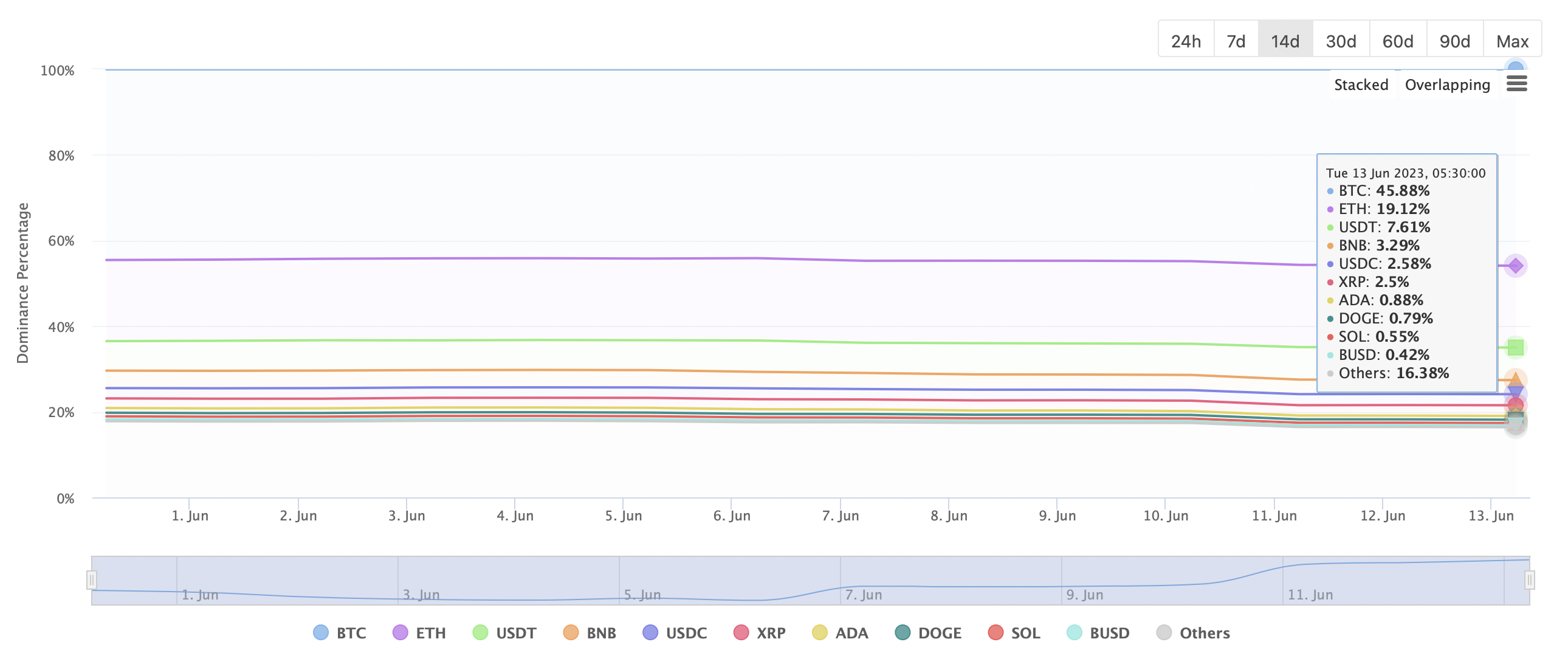

Bitcoin observed a rise in its dominance as capital flows left other risk assets and altcoins in the crypto ecosystem due to the SEC’s crackdown.

The overall crypto market capitalization declined from $1.13 trillion on June 5 to $1.09 trillion at the time of writing. In the same timeframe, Bitcoin dominance climbed from 44.21% to 45.88%. Since the beginning of 2023, BTC dominance increased 19%, based on CoinGecko data.

Declining market capitalization and increasing BTC dominance suggests that capital is being rotated from altcoins to Bitcoin and this is bullish for BTC price recovery in the long term. It supports the thesis of a bullish market sentiment among participants towards BTC.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP decline as President Trump’s team considers “broader and higher tariffs”

Bitcoin continues its decline, trading below $82,000 on Monday after falling 4.29% the previous week. Ethereum and Ripple followed BTC’s footsteps and declined by 9.88% and 12.40%, respectively.

XRP Price Forecast: Weak demand and rising supply could trigger a downtrend

Ripple's XRP is down 7% on Friday following bearish pressure from macroeconomic factors, including United States (US) President Donald Trump's tariff threats and rising US inflation.

Crypto Today: XRP, SOL and ETH prices tumble as South Carolina moves to buy up to 1 million BTC

Bitcoin price tumbled below the $85,000 support on Friday, plunging as low as $84,200 at press time. The losses sparked over $449 million in liquidations across the crypto derivatives markets.

Hackers accelerate ETH decline following $27 million dump, bearish macroeconomic factors

Ethereum (ETH) declined below $2,000 on Friday following a series of hacks traced to accounts of crypto exchange Coinbase users, which caused a loss of $36 million.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.