What is a risk profile? Definition, examples and types

A risk profile is a quantitative analysis of the types of threats an organization, asset, project or individual faces. Its goal is to provide a nonsubjective understanding of risk by assigning numerical values to variables representing different types of threats and the dangers they pose.

Each organization has a unique risk profile based on the assets it wants to protect, the goals it wants to achieve, its ability to handle risks and its willingness to do so.

Why is a risk profile important?

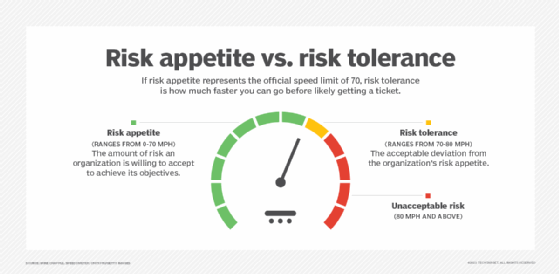

Organizations use risk profiles to align their strategy and actions with their risk or investor appetite -- that is, the level of risk they are willing to accept after the relevant controls have been put in place.

In the enterprise, a management team's ability to understand and measure gaps between a company's risk profile and its risk appetite is an important aspect of running a successful enterprise risk management program.

In finance, a risk profile can be a useful tool for discussing and evaluating a potential investment's ability to maximize return on investment while minimizing risk.

Individuals can also develop a risk profile as they seek to make decisions that align with their risk appetite. For example, people often develop a risk profile to help them make investment decisions that are not too risky but still enable them to set and reach financial objectives.

What is included in a risk profile?

A risk profile considers the following:

- The nature of the threats that an organization faces as it operates and works toward its objectives.

- The degree to which those threats could adversely affect the organization.

- The likelihood that those threats will affect the organization.

- The type of disruptions that could occur if those threats affect the organization.

- The costs associated with each type of risk.

- The controls that the organization has in place to manage or mitigate the identified risks facing the organization.

What types of risk should be accounted for?

As noted, every enterprise has its own unique mix of risk factors, but those risks generally fall within one of the following four risk categories:

- Strategic risks. These could come from outside forces, such as competitors entering new markets, technology innovations rendering the organization's products or services obsolete, or unexpected significant shifts in customer demands.

- Operational risks. Operational risks are issues that could disrupt the day-to-day running of the organization. Supply chain problems, personnel issues, equipment malfunctions and disputes with third-party partners are some of the risks that could impact an organization and should be considered when developing a risk profile.

- Financial risks. These could include disruptions in cash flow, losses on bad investments, the lack of needed liquidity, market volatility and interest rate fluctuations.

- Compliance, legal and regulatory risks. These include risks to a company's reputation or finances due to violation or noncompliance with external laws and regulations, resulting in fines, legal actions or lawsuits.

The benefits of a risk profile analysis

Risk profiling can help organizations or individuals do the following:

- Identify and prioritize risks, enabling better resource allocation and budgeting.

- Assess the level of risk different activities and decisions pose.

- Provide a clear understanding of investment risk, helping improve the decision-making process.

- Set realistic expectations and investment strategies to build confidence in future returns.

- Identify and assess risks to develop targeted risk mitigation strategies.

- Proactively identify potential problems, enabling timely mitigation.

How to create a risk profile

Developing a risk profile should involve stakeholders throughout the enterprise who work together to complete the following tasks:

- Establish the organization's risk appetite. This should consider the organization's ability to deal with risk and its risk tolerance -- the deviation from risk appetite it is willing to assume to accomplish specific goals.

- Identify all potential risks within each of the four risk categories. Examine the risks listed above that could negatively affect the organization, the level of impact those risks could have and their probability of occurrence.

- Rank or prioritize risks. This ranking or prioritization should be based on the potential impact of the risks on the enterprise and their likelihood of occurring. An organization might want to develop a risk map, which is a visual representation of this information.

- Further rank risks. The risks should be further broken down by organizational units, risk types, geographies, strategic objectives and other relevant subcategories.

- Determine the format that best suits the presentation of the risk profile. This will help ensure the information is understandable to the stakeholders who will use the profile for decision-making.

Enterprise executives should include the risk profile in their strategic planning and ongoing decision-making processes. They should also use it to inform the governance and controls they implement to manage and mitigate risk.

Moreover, they should ensure that they revisit the risk profile regularly and update it whenever risks, the organization's appetite for risk or both significantly change.

This enterprise risk management market offers many tools to help organizations identify, mitigate and remediate business risks. Learn about the tools available and their functionalities.